Inexpensive passive portfolios appeal to many investors, though they don’t offer the possibility of generating additional returns in a low-return world and have limited ability to impact companies on ESG issues. Active core equities are the largest asset class in the vast universe of stock portfolios. Yet despite the abundance of choice, it’s often hard for investors to know exactly how a core portfolio generates its returns and adds value for its clients.

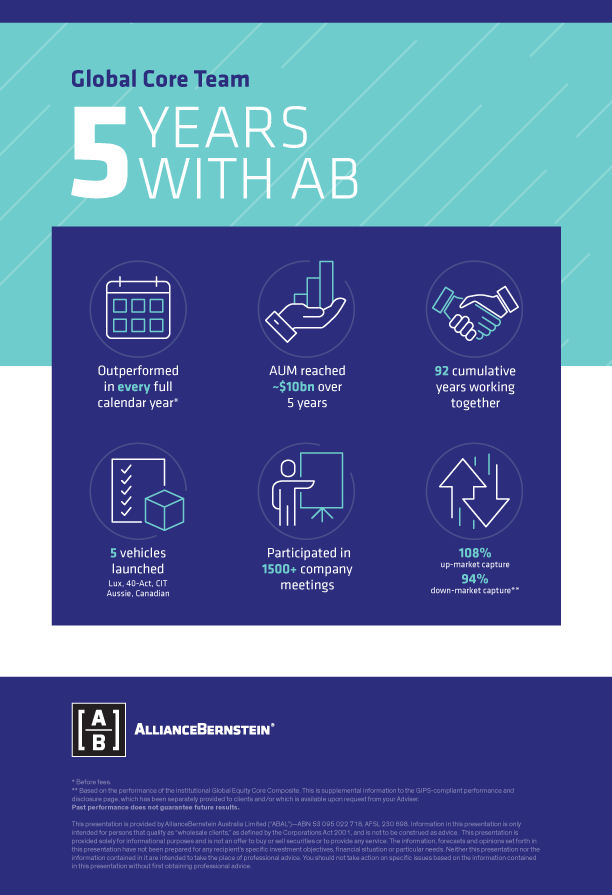

AB’s Global Core Equity Strategy aims to provide investors with transparent returns that are driven by stock-picking skill and aren’t unduly influenced by unpredictable market forces or style biases. And in July 2019, we celebrated the five year milestone of AB Global Core Equity – that is, five years of success.

The Global Core Equity team joined AB from Danish investment boutique firm CPH Capital in July 2014. In the team’s five years at AB, it has continued to build on a long track record of success that stretches all the way back to 2004.

Here’s what AB’s Global Core Equity strategy offers:

-

Active, fundamental stock selection. The team uses long-term, cash-flow-based stock-picking techniques to identify companies that consistently add value—and that can invest to grow their businesses. The team looks to buy these stocks at an attractive price.

-

Fewer unintended biases. Factor returns are episodic and volatile. But the Global Core Equity team has consistently outperformed by focusing on stock selection as the primary source of alpha.

-

Downside protection. Our portfolio of value creators, combined with minimized unintended biases, has provided downside protection during periods of market decline.

Learn more about the Global Core Equity team and its portfolio strategy.

This presentation is provided by AllianceBernstein Australia Limited (“ABAL”)—ABN 53 095 022 718, AFSL 230 698. Information in this presentation is only intended for persons that qualify as “wholesale clients,” as defined by the Corporations Act 2001, and is not to be construed as advice. This presentation is provided solely for informational purposes and is not an offer to buy or sell securities or to provide any service. The information, forecasts and opinions set forth in this presentation have not been prepared for any recipient’s specific investment objectives, financial situation or particular needs. Neither this presentation nor the information contained in it are intended to take the place of professional advice. You should not take action on specific issues based on the information contained in this presentation without first obtaining professional advice.