We believe “smoothing the ride” through the market’s ups and downs requires careful design and dynamic active management. The second of our four key steps in implementing a low-volatility equity strategy successfully is:

Avoid “volatility traps”—stocks that have shown low volatility but could change.

Quantitative research alone isn’t enough to protect against the harsh realities of life. Even stocks that score highly on each factor can fall prey to unexpected developments that undermine their prices.

For example, a utility company in a sector that is undergoing a large-scale regulatory review may appear to be stable. But the stability won’t necessarily be permanent if the outcome of the regulatory review could hurt the utility. This is the so-called volatility trap.

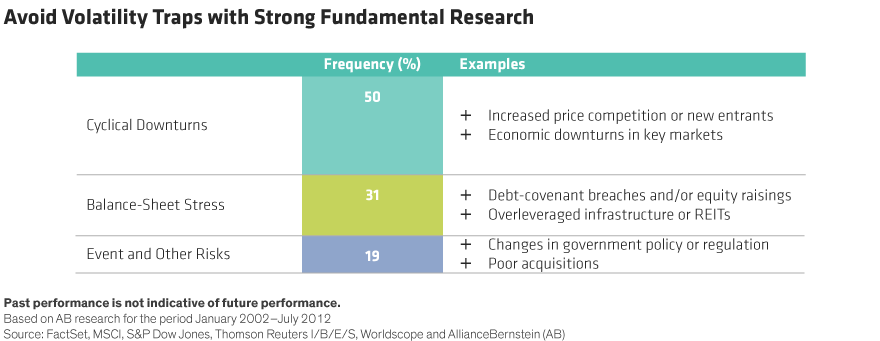

Volatility traps usually result from stock-specific causes, and the way to avoid them is with fundamental, bottom-up stock research. Our research shows that cyclical downturns account for 50% of volatility traps, followed by balance-sheet stress and event risk.

Cyclical risk can manifest itself through a broad economic or business downturn, changes in a company’s key markets—such as a slump or the entry of new competitors—and increased price competition, as seen among Australian supermarkets in recent years. Quantitative research provides insights into a company’s balance-sheet strength from a numerical perspective, and fundamental research can reveal factors such as the willingness of lenders to provide credit and the price they would charge for it.

Event risk can be unexpected, such as a change in government or regulatory policy, the restatement of company earnings, or an acquisition that falls short of expectations. It can also be expected, such as a forthcoming regulatory or legal ruling that could hurt the stock price. In the case of expected event risk, the best course of action for investors focused on the downside can be to stay on the sidelines, and not own the stock until the risk outcome is known.