As the effects of the coronavirus wreck economies, banks are facing increased loan-loss risks and prioritizing capital conservation. Their additional Tier 1 (AT1) securities should survive a short bout of the virus. But even in a prolonged pandemic, the risk/reward trade-off might be better than perceived.

Revenue shortfalls are spreading across industries, forcing lenders to increase their loan-loss reserves. Mounting realized losses threaten subordinated credits, and European banks’ AT1s are seen as most at risk. Even so, we believe AT1s issued by stronger European banks can earn attractive returns.

How Banks Prepared for the Next Crisis

The COVID-19 pandemic is both a human tragedy and a huge and unpredictable problem for businesses worldwide. Banks are facing complex risks that are unusually hard to model.

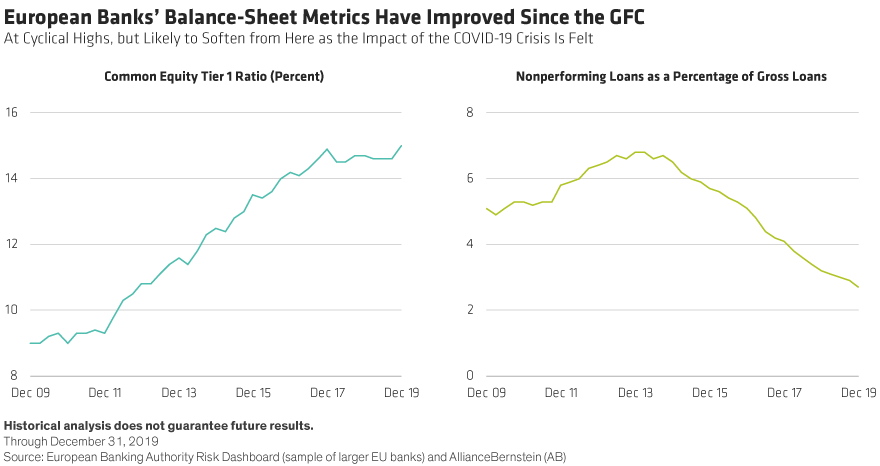

But lenders have stronger balance sheets today than they had a decade ago. As a result of tougher regulation following the global financial crisis (GFC), banks have greater financial flexibility to cope with unpredictable events. In Europe, for example, capital ratios have improved significantly since the GFC, and nonperforming loans represent a much lower proportion of total loan books (Display).

To help delever, European banks also shrank their balance sheets, judiciously limiting lending and new credit. Even those banks with lower asset quality, such as Italian banks, improved their banking books—particularly systemic Italian lenders—creating a more robust banking system.

Balance-sheet structures have changed too. Regulators want greater resilience as well as higher capital. Consequently, AT1s have become popular as a flexible buffer to help absorb shocks.

For regulatory capital purposes, Tier 1 capital absorbs losses immediately when they occur on a “going concern” accounting basis. Tier 1 capital comprises common equity—termed common equity Tier 1 (CET1)—and AT1, which ranks higher than does CET1. Rising bank losses erode equity capital. Ultimately this may reduce CET1 below the minimum level required to pay the AT1 coupon.

Banks Face Tough Questions on AT1s

Investors in AT1s have accepted unique risks in return for premium yields. But after fears of worst-case outcomes hit AT1 prices, concerned investors want answers to key questions:

Will AT1 coupons be sacrificed to conserve capital? With European AT1s, coupons can be suspended when capital ratios deteriorate below specified capital levels and/or at the discretion of the regulator or the bank.

The Bank of England (BoE) and the European Central Bank (ECB) have already directed banks to conserve capital by suspending their equity dividends and share buybacks. That’s led to concerns that AT1 coupons are next to be cut.

The ECB has been quick to clarify that its directive refers only to equity dividends and not to bond coupons. But in our view, this technical distinction is much less meaningful than understanding the risk/reward ratio for the banks as they seek to conserve capital.

We believe the effects of the coronavirus have modestly increased the risk to AT1 coupon suspension because of the likely increases in realized losses and capital deterioration. But that risk remains very low.

Euro-area banks have several ways to boost the CET1 component of their balance sheets. The biggest uplift comes from the ECB’s emergency relaxation of banking regulations, such as slower recognition of nonperforming loans and/or a temporary lower capital requirement. These changes could free up around €300 billion of additional CET1 for euro-area banks, according to Autonomous Research. Cutting equity dividends and share buybacks also saves over €40 billion.

In contrast, switching off AT1 coupons would release only around €10 billion. Such cuts would be counterproductive. They would save a relatively small amount but would damage bond investors’ confidence in the AT1 market, driving up the banks’ cost of capital in future funding rounds.

However, we think investors do need to be realistic about extension risk—that is, the risk that banks will decide not to call their AT1s at the first scheduled date. We believe that banks will and should treat this decision on purely commercial grounds rather than as a reputational issue. So if business conditions remain depressed and refinancing the bonds proves uneconomic, non-calls will become more regular occurrences.

If the crisis persists, can European banks sustain their loan losses? The 2018 ECB and 2019 BoE stress tests indicated that most UK and European banks could sustain significant loan losses before breaching triggers that would impair AT1s.

Coronavirus risks are harder to quantify, and European bank CET1 ratios are already starting to erode because of substantial new loan-loss provisions and realized losses. But since European lenders entered the crisis in good shape, we believe the current valuations of the stronger banks’ subordinated debt should compensate for the risks in all but the worst-case scenarios.

Investors should also recognize the significance of the unprecedented support packages launched by governments across Europe. These are highly important in terms of potentially reducing the banks’ ultimate loan losses, and together with low rates and regulatory easing are intended to avoid worst-case outcomes for businesses and employees.

Viewed in that perspective, risks are more containable than many initially feared. And if rates stay low, as we expect, today’s high AT1 yields are likely to prove attractive to income-seeking investors.

Will bank holdings in peripheral eurozone government debt create systemic risks? European banks have large government bond portfolios, albeit skewed to domestic government bonds, which carry zero risk weights for capital adequacy purposes.

This asset strategy has raised fears of a “doom loop” for banks in weaker euro-area countries. When such banks hold the sovereign debt of their own country, the country’s rising sovereign bond yields impact the balance sheets of its banks, which in turn further destabilizes sovereign creditworthiness.

We believe these fears are overdone. Although European banks’ holdings of sovereign debt are high, they are typically well-diversified.

More importantly, the ECB has pledged to do everything in its power to keep the yield curve well anchored and sovereign bond yields low. It is committed to providing unlimited liquidity to commercial banks.

Further, to keep credit flowing to the real economy, it has already relaxed the banks’ capital requirements and enhanced the funding support vehicles that effectively subsidize participating lenders (including the new small and medium-sized enterprises (SME) Term Funding Scheme in the UK and targeted longer-term refinancing operations (TLTRO3) with more favorable terms in the eurozone).

European governments are also fully aware they must keep their commercial banking systems stable and ensure that their banks are capable of continuing to provide credit to the real economy.

Ultimately, European sovereign governments will need to make hard decisions about the political and institutional architecture of the eurozone to secure the EU’s future. But for the medium term, we believe the ECB is capable of keeping sovereign yields stable and that even weaker euro-area sovereigns can repair their solvency positions over time.

When risks are unquantifiable, should investors avoid AT1s? Despite the recent rally bond markets are still pricing in relatively adverse outcomes, despite support from massive central bank interventions and government relief programs.

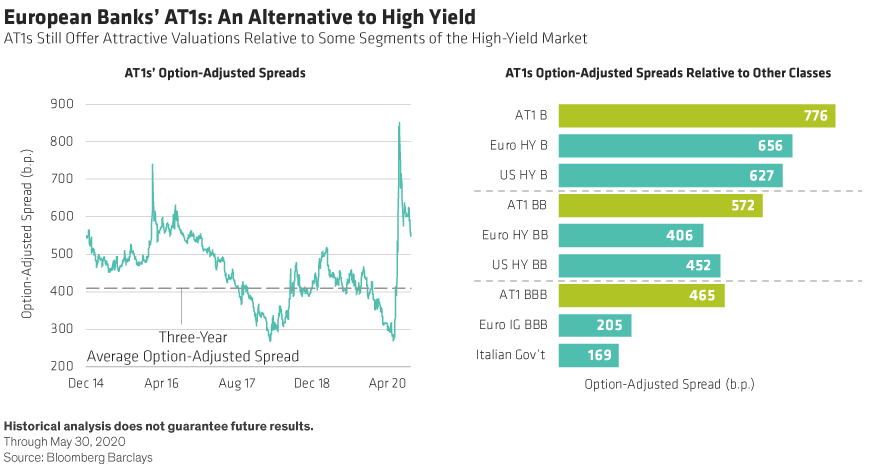

For example, although the default rate is expected to increase, in euro high yield, current spreads of 4% to 7% for bonds rated from BB to B compensate for the increased risk. For AT1s issued by European banks, spreads are even wider, ranging from about 6% to 8% (Display), even though these securities have a high probability of maintaining coupons and returning their principal. That’s an attractive risk/return balance, in our view, particularly given the ECB’s support and the strength of banks’ balance sheets.

In the aftermath of the crisis, profitability for banks and for many nonfinancial sectors could remain depressed for some time, impacting the outlook for equity investors. But bond investors are focused more on the balance sheet than on the profit and loss account.

From that perspective, we believe investors will find that the AT1s of select larger, stronger European banks—including national champions with the resources to withstand a prolonged crisis—offer surprisingly resilient return potential.

Jørgen Kjærsgaard is Co-Head of European Fixed Income and Director of European and Global Credit, and Steve Hussey is Head of Financial Institutions Credit Research, both at AB.

Past performance is no guarantee of future results.

This article is not intended as investment advice. Readers should make sure they obtain appropriate advice from their financial advisor before making an investment.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time. AllianceBernstein Limited is authorized and regulated by the Financial Conduct Authority in the United Kingdom.