A strong global bond rally, courtesy of massive central bank responses to the COVID-19 pandemic, has left government bond yield curves very low—with negative yields not uncommon. Policy rates have been slashed, quantitative easing programs launched or reignited, and an alphabet soup of unconventional measures rolled out to shore up financial markets and support fiscal rescue packages.

Chinese government bond yields, however, have bucked the trend, with 10-year bond yields climbing from their April lows of 2.4% to top 3%, putting them at pre-COVID-19 levels. Does this signal the path ahead for other global bond yields, or will the “Japanification” of global bonds drag China’s government bonds back to low-yielding territory?

To understand what might be next for Chinese government bonds, it helps to look closer at how they got to this point. We attribute the trend of rising bond yields to three factors:

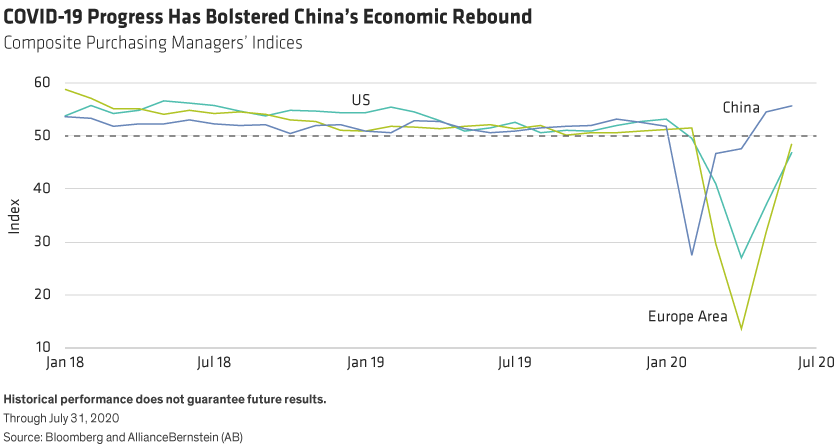

1) A stabilizing economy has caused a rotation into equities. China has recovered from virus lockdowns faster than other regions and, to date, has avoided sizable second-wave infections plaguing other nations. This has enabled China’s economic activity to rebound more quickly (Display).

A largely contained virus and well-timed media coverage intimating that policymakers were greenlighting a stronger equity market combined to provide plenty of motivation for aggressive Chinese retail investors to join the flows from bonds into equities.

2) The market anticipated fixed-income supply pressure. The Chinese government put its shoulder behind the economic bounce. It hasn’t rivaled post-global-financial-crisis stimulus but has been big enough for markets to worry about how it will be repaid. As China’s fiscal deficit has risen by 4%–5%, we’ve seen a commensurate rise in issuance of government bonds, policy-bank bonds and special local government bonds to finance it.

China’s bond market didn’t sit idly by and wait for this supply to arrive. Forward-looking investors reduced their exposure ahead of it. We expect bond supply to remain heavy until at least October 2020, but we also think the bond market has already priced in the added supply.

3) The central bank signaled a stable/neutral policy setting—not more easing. Instead of focusing on more policy accommodation, the People’s Bank of China (PBOC) has not adopted a “whatever it takes” approach to monetary policy easing as have the Federal Reserve and other major central banks.

Sure, lending rates have been reduced, with the one-year medium-term-lending-facilities rate cut from 3.30% in November 2019 to its current 2.95%. But that seems measured compared with the Fed’s 150- basis-point cut. In terms of the availability of short-term liquidity in the banking system, the PBOC’s open-market operations have been quite balanced and liquidity even tightened a little.

What’s Next for China’s Bond Market?

Because we believe that China’s government bond yields largely reflect those three drivers, we think bonds’ next move will be driven by how the Chinese economy performs into 2021, after this post-virus bounce. In our view, the Chinese economy will need more easing in 2020 and beyond. Policymakers are “saving their bullets” for now, but we still anticipate further reserve requirement ratio (RRR) cuts and small reductions in benchmark lending rates heading into the end of the year.

Inflation, measured by producer prices, is still negative, unemployment levels will likely remain high and export volumes and retail sales are likely to stay sluggish. This suggests that China won’t be able to rely on a strong domestic consumer or robust global recovery for help. In this environment, we think there’s room for China’s government bond yields to retrace some of their second-quarter price losses (higher yields) and begin to position for a return to monetary easing and additional liquidity injections. If this scenario plays out, Chinese bond yields will likely head lower, bringing them somewhat closer to their global counterparts.

The RMB: Likely to Remain Stable…with Room to Gain

Because the PBOC has parted ways from other central banks’ broad-based easing measures to focus on targeted easing, such as encouraging lending to small- to medium-size enterprises, interest-rate differentials have widened substantially, providing support for the renminbi (RMB). The currency has yet to respond to this attractive rate gap, which should encourage flows into China’s financial markets.

This suggests room for further RMB appreciation. In fact, China’s currency has recently lagged several of its trading partners’ currencies and is now at the middle or lower segment of its trading range against global peers. Our long-term valuation measures for the RMB also indicate that it’s undervalued (Display). So, in addition to the domestic factors supporting the RMB—higher interest rates and a relatively stronger COVID-19 recovery—we also see upside in the global context.

China Bonds’ Divergence Represents an Opportunity

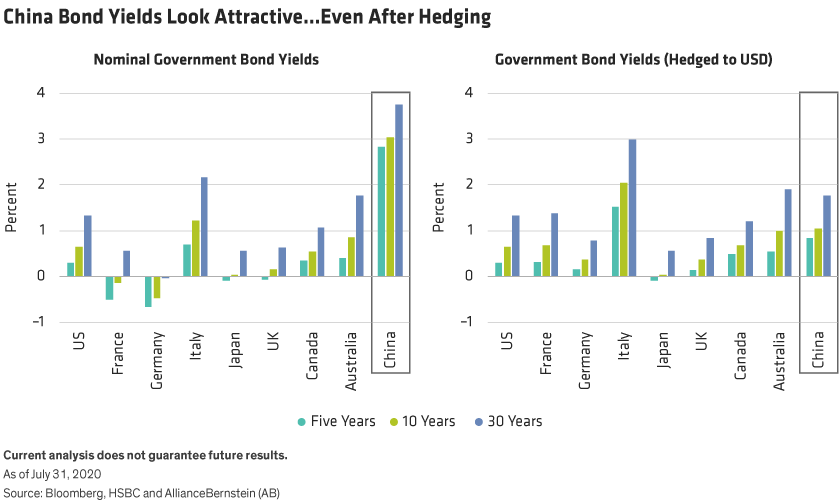

Historically, an allocation to Chinese government bonds has improved risk-adjusted returns by dampening volatility for global bond investors. China’s bond market is driven largely by unique domestic factors. The latest divergence from global bond trends is a case in point—and an opportunity, in our view, even after factoring in currency hedging costs (Display).

Despite strong foreign portfolio flows in recent months, China’s bond market is still underowned by global investors, in our view. Foreign ownership is about 9%, but under 5% when considering the full onshore market. Government and policy-bank bonds are already part of the Bloomberg Barclays Global Aggregate Bond Index, and the likelihood they’ll join other popular global bond indices into 2021 and beyond provides further impetus for portfolio inflows.

Given the landscape, we think China bonds represent an opportunity over the long run, especially given the appeal of current valuations versus other global government bond markets—and our cautious fundamental view for the domestic economy. As we see it, China’s bond yields will likely decline in 2020 and beyond, and the RMB will likely remain at least stable—with room to appreciate.

Brad Gibson is Co-Head of Asia Pacific Fixed Income at AllianceBernstein (AB).

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.