The likelihood that the world is moving towards a higher structural inflation regime in the medium term (the next three or four years) is a potentially important planning horizon for many investors. How should they think about, and prepare for, the likely risks and opportunities?

There are many investment strategies they can consider. All, in our view, should have one thing in common: they should be active. That’s because active strategies are well suited to navigating changing investment environments over the short, medium and long terms.

Below, we recap our short-term outlook and provide three checklists to help active equity investors navigate the post-COVID economic recovery. (In future articles, we’ll look in more depth at appraising stocks appropriately in the current environment, and at the medium-term outlook.)

CHECKLIST 1: INFLATION RISK

Now that vaccination roll-outs have started to contain the pandemic in some countries, the global economy is beginning to normalize, which means that economic growth will probably face many of the same challenges that prevailed before the pandemic.

While there is room, in our view, for stocks to advance in this recovery, there are risks, too. They can be divided into two groups: policy risks and the risks that go with a “return to normal”. The policy risks concern inflation and interest rates.

There has been much debate recently about whether higher inflation outcomes reflect temporary factors (such as the low base effects for year-on-year readings created by the COVID-induced slowdown in 2020) or more permanent ones.

The consensus favours the temporary view, and markets—which are not pricing in a significant shift in inflation relative to where it stood pre-COVID—seem to agree. The point for investors, however, is that inflation risk is now much more on markets’ radar than it was a year ago.

(Note that this debate mainly concerns the short-term inflation outlook; our outlook for higher structural inflation in the medium term draws on factors which are longer-term than the cyclical inputs that tend to inform monthly or quarterly CPI readings.)

As our first checklist shows, active investors can prepare for higher inflation in three ways:

Investors should ensure, for example, that their portfolios include companies with pricing power, which is an advantage in an inflationary environment. Equity allocations should also be diversified across stocks that may respond differently to higher inflation and interest rates, including real-estate stocks and commodity stocks, which tend to perform well when inflation rises.

CHECKLIST 2: INTEREST-RATE RISK

Inflation risk traditionally raises the prospect of higher interest rates. But the policy outlook for interest rates has been complicated by a divergence among central banks according to those that favour a “tighter sooner” approach and those that take a “looser longer” view.

Among the major central banks, the US Federal Reserve, which has flagged a tapering of its QE programme, belongs in the former category, while the European Central Bank and Bank of Japan occupy the latter. Among smaller developed-market central banks, the Reserve Bank of New Zealand aligns with tigher sooner and the Reserve Bank of Australia with looser longer.

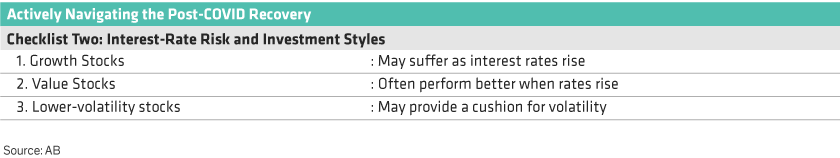

Investors with global portfolios need to bear these macro divergences in mind. One way for active equity investors to approach interest-rate risk is to understand how it can affect different investment styles, as our second checklist shows:

Rising rates increase the discount rate that investors use for valuing equities. This suppresses price/earnings multiples, particularly for growth stocks, which tend to have cash flows and earnings in the more distant future. Value stocks often perform better when rates rise.

For investors with large allocations to growth and underweights to value, it may be time to reassess. We think value stocks still have recovery potential. For growth stocks, it’s important to verify that holdings have solid business drivers and resilient cash flows to support sustainable returns if multiples come under pressure.

Stocks in the middle—such as lower-volatility stocks—have largely been shunned throughout the pandemic. But many defensive sectors, such as consumer staples and utilities, trade at attractive valuations and could help provide a cushion for volatility.

CHECKLIST 3: “RETURN TO NORMAL” RISK

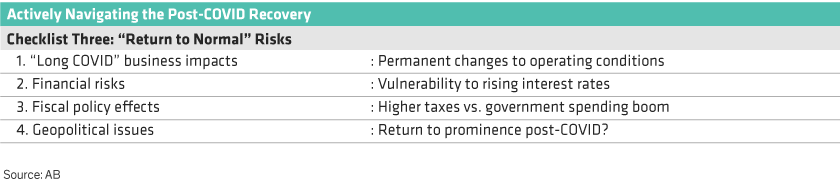

Many companies’ fundamentals were impaired by the pandemic. When economic shutdowns began, business visibility disappeared, particularly in hard-hit industries. As economies reopen, many questions remain unanswered, as our third checklist shows:

What permanent or long-lasting changes do companies and sectors face as a result of the pandemic? What strategies do they have for dealing with them? How, for example, will consumers and businesses recalibrate spending for the new normal? Will some industries face oversupply—for example, of aircraft, hotel rooms or office space?

If rates rise, how will debt-laden companies cope? Financing risk warrants thorough scrutiny of balance sheets to identify companies that didn’t prudently manage their debt when rates were low.

Portfolios with US holdings—or investments in Australian stocks with US operations—may be subject to higher taxation as a consequence of the Biden administration’s massive spending plans (they may, of course, also benefit from higher government outlays on infrastructure).

Political risk is hard to predict, but company exposures to specific political risks can be pinpointed to help ensure that a portfolio isn’t too vulnerable to some of the biggest hazards.

SELECTIVE STOCK PICKING IS IMPORTANT

To understand how companies are positioned for the new normal requires independent research of their businesses. Demand must be assessed in real time, using new data analysis techniques to determine which companies have adjusted well from crisis to recovery.

There aren’t simple answers. But these questions—and the risks associated with the inflation and interest-rate outlooks—all point to the importance of active investing through the recovery.

The views expressed herein do not constitute research, investment advice or trade recommendations, do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.