The AB Managed Volatility Equities Fund (Managed Fund)—MVE Class (“MVE Class”) is now available on the securities market. Trading under the ticker code of AMVE, investors can now access the MVE Class via Chi-X, an innovative securities and derivatives exchange.

This new access model was introduced in April 2021 in response to adviser and client feedback. Many advisers told us they had clients wanting to access our low volatility equities strategy on the securities market. And now, we are pleased to offer investors the opportunity to buy/sell MVE Class units in the same way they can buy/sell shares in listed securities.

ETFs have become increasingly popular in recent years as they allow investors to hold a range of assets such as bonds, shares or commodities in a single trade. And, in the same way a stock is traded on an exchange, an ETF is similarly traded so its price adjusts accordingly at regular intervals throughout the day.

AB’s Managing Director of Retail, Ben Moore, emphasizes that this new vehicle from AB is an active ETF and will be managed the same way as the existing MVE Class managed fund.

“Of the hundreds of ETFs available in Australia today, there are those that are actively managed and those that track the index”, he said.

“Our new ‘active’ ETF does not aim to track an index. Instead it is made up of a portfolio of securities actively managed by our award-winning investment team. The MVE Class active ETF is designed to provide investors with access to this same investment expertise but without having to invest in the managed fund.”

Jen Driscoll, AB Australia CEO said this is the first active ETF launched by AB globally.

“We believe the active ETF structure really allows us to leverage our global operational infrastructure appropriately as well as provide unit holders and potential investors with greater flexibility,” she said.

“We’re pleased that we have been able to take on board the feedback from financial advisers and provide them with a more flexible offering for their client base.”

We’re now 12 months on from the beginning of the COVID-19 pandemic, and many investors are still feeling the impact. There’s little doubt that, during times of heightened market volatility, to be forced to sell when markets are down is the worst outcome for any investor. And while markets usually recover, an investor’s ability to absorb this volatility depends on their investment timeframe.

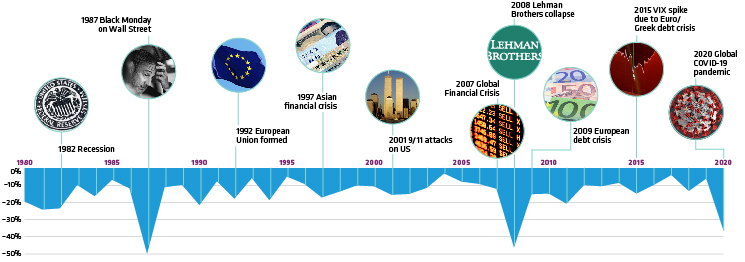

While long-term investment returns can mask the underlying short-term volatility of the asset class, it is easy to forget that equity downturns are quite common and can be severe (Display). In two out of every three years, the market has experienced declines of 10% or greater from peak to trough over the period of 40 years. This volatility is a challenge for all investors, irrespective of where they are in the investment lifecycle.

Volatility: A Challenge for All Investors

S&P/ASX All Ordinaries Drawdowns*

*Largest peak to trough move.

Through 31 December 2020. Source: S&P Dow Jones

Since its inception seven years ago, the MVE Class has aimed to deliver investors a smoother performance pattern and downside risk capture by combining the complementary and compensating characteristics of price stability, high quality cash flows and reasonable valuations.

Now, with the launch of AMVE available through Chi-X we’re opening up this strategy to investors who have perhaps shied away from managed funds in the past.

Individuals can invest in the MVE Class active ETF directly via their online broking account. Alternatively, they can invest directly with the MVE Class. The MVE Class is offered on a number of industry leading platforms and investors can buy units directly from AB provided they apply for the minimum investment of A$50,000 in units.

Learn more about MVE Class.

AllianceBernstein Investment Management Australia Limited (ABN 58 007 212 606, AFSL 230 683) (“ABIMAL”) is the responsible entity of the AllianceBernstein Managed Volatility Equities Fund (Managed Fund)—MVE Class (ARSN 099 739 447) (“MVE Class”) and is the issuer of units in the MVE Class. AllianceBernstein Australia Limited (“ABAL”) ABN 53 095 022 718, AFSL 230 698 is the investment manager of the MVE Class. ABAL in turn has delegated a portion of the investment manager function to AllianceBernstein L.P.(“AB”). The MVE Class’ Product Disclosure Statement (“PDS”) is available by contacting the client services team at AllianceBernstein Australia Limited at (02) 9255 1299 or at http://www.AllianceBernstein.com.au. Investors should consider the PDS in deciding to acquire, or continue to hold, units in the Fund.