As the road back from the COVID-19 pandemic continues, the reopening has been accompanied by healthy merger and acquisition (M&A) activity—which was, in many cases, shelved during the pandemic. Management teams are feeling a growing urgency to reshape their businesses, but also surging optimism: in the second quarter, The Conference Board’s Measure of CEO Confidence reached an all-time high.

Firms are seeking ways to broaden their scope and increase scale while boosting growth and resiliency. Shoring up supply chains disrupted by the pandemic, diversifying manufacturing footprints, applying technology to advance business operations—with interest rates still low and competition intensifying, there’s a strong incentive for management teams to act.

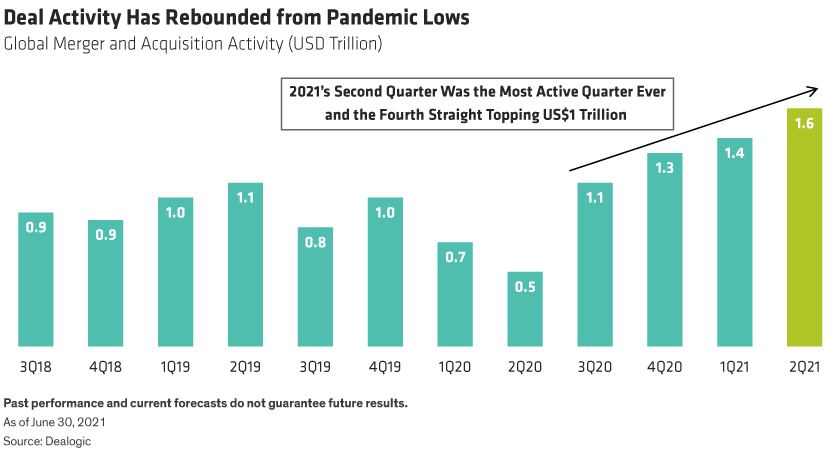

Healthy M&A activity reflects the enthusiasm. In the second quarter of 2021, global M&A volume was up more than 225% year over year: $1.6 trillion versus $475 billion in the second quarter of 2020, according to Dealogic. Through the first half of 2021, the market has seen roughly $3 trillion in total deal value, making the first half of 2021 the most active half-year on record.

More Deals, Fewer Breaks: Favorable Trends

We believe that two key trends bode very well for merger arbitrage performance: the increased deal flow we’ve described and an expected decline in the frequency of deals that fall through, or “break.”

The current healthy level of deal activity makes it easier for investment managers to diversify the deal-specific risks across a larger number of transactions. This diversification is an important tool in limiting the negative impact of a single deal that fails to play out as expected. The ability to achieve better diversification, in our view, supports higher return potential in the merger arbitrage arena.

The second favorable trend is the buttressing of merger agreements that has taken place in response to the enormous disruptions wrought by COVID-19.

Merger agreements are now being crafted in ways that make them stronger, often including specific clauses to prevent acquiring organizations from using the pandemic as a “material adverse event” and a reason to exit a previously agreed-to transaction. We anticipate that this behavior will likely reduce the number of broken deals, which were above average in 2020 due to the pandemic’s unprecedented nature.

From the broader perspective, we think the post-COVID-19 backdrop stands a good chance to play out similarly to the experience in the wake of the 2008 global financial crisis. With those disruptions, M&A deal activity first slowed down dramatically, followed by a rebound in activity accompanied by stronger merger agreements and below-average deal breaks.

It’s also promising that many private-equity firms and corporations have a significant level of dry powder, with the world awash in liquidity. In our experience, many firms use M&A as a tool for growing revenue, acquiring competitors to rationalize pricing or addressing supply chain challenges. Indeed, we’re seeing many management teams thumbing through those playbooks now.

Environment Stacks Up Well for Systematic Merger Arbitrage

Merger arbitrage strategies have provided consistent returns over both the short and long term. Of the 40 HFRI1 strategies, merger arbitrage has produced the second-highest Sharpe ratio, the fifth-smallest maximum drawdown, and an average annualized return of 7.4%, with only two down years since its inception in December 1989.

In taking advantage of rejuvenated M&A activity, our view is that the landscape favors a systematic approach to merger arbitrage. For one thing, many traditional hedge funds have actively invested in merger arbitrage, and the primary added value has been their ability to select the right deals to invest in. Often, their information edge drives success: mainly, the insight into which deals were more likely to close or break.

But the nature of the market for merger arbitrage strategies has evolved. Oversight changes such as Regulation Fair Disclosure, which is intended to reduce the amount of selective information disclosure, coupled with greater technology-enabled information dissemination, has significantly eroded the ability to turn information into an advantage over peers. This has created more space for systematic merger arbitrage approaches to thrive.

Traditional hedge fund managers typically charge investors relatively high fees to access merger arbitrage strategies, including both a management fee and performance fee. The two-and-20 fee structure, with an annual fee of 2% of assets under management plus 20% of profits beyond a specified benchmark, is quite common.

By investing in merger arbitrage systematically, we believe that investors are able to access more of the returns associated with merger arbitrage risk premia with much lower fees. Why is this? Many traditional merger-focused hedge strategies focus on fundamental deal selection. This approach can be effective, but it also could lead to higher portfolio concentration, as managers allocate more capital to the deals they believe are most likely to close.

In contrast, strategies applying rules-based implementation are typically more diversified. This can create advantages, including the broader capture of deals that may receive competitive bids or higher offers. Also, many systematic merger-arbitrage strategies use leverage to manage risk and diversify, as opposed to increasing potential returns on high-conviction ideas. This practice can allow systematic strategies to incorporate new deals without having to replace existing deals that will be profitable.

To sum things up, given the patterns and trends we see in the M&A space as the economic reopening from the pandemic plays out, we believe that the environment remains highly supportive for systematic merger arbitrage strategies.

Scott Schefrin is Portfolio Manager for AB Custom Alternative Solutions, Junichiro Goto is Managing Director for AB Multi-Asset Business Development and Chris Mason is Product Manager for AB Systematic Alternatives.

1HFR indices are broadly constructed indices designed to capture the breadth of hedge fund performance trends across strategies and regions.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.