Roy Maslen, Chief Investment Officer—Australian Equities

We believe “smoothing the ride” through the market’s ups and downs requires careful design and dynamic active management. The third of our four key steps in seeking to implement a low-volatility equity strategy successfully is:

Diversify: the index reflects the listed stocks, not necessarily the most effective stocks.

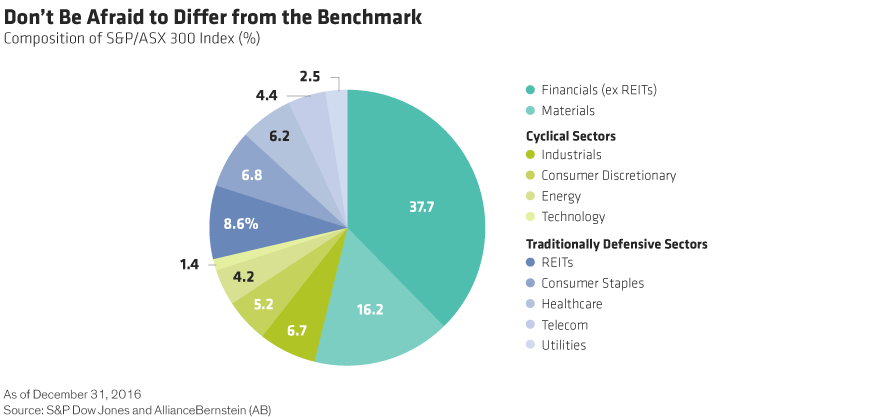

The Australian equity market is relatively small, dominated by financials, resources and a handful of large-cap stocks: in recent years, typically 10 to 15 stocks have accounted for around 50% of the S&P/ASX 300 Index (Display).

To some extent, this sector skew reflects the skew of the economy, and to some extent it reflects the companies that happen to be listed on the stock exchange. A stock’s index weight does not reflect its attractiveness as an investment: being big does not necessarily mean being beautiful.

A closer look at the index reveals other challenges:

- Some sectors and subsectors are almost nonexistent in the Australian index. And unfortunately for those looking for a smoother ride, the “missing sectors” include some of the lower-volatility industries, such as branded consumer goods, pharmaceuticals and some technology stocks.

- Some sectors, even though they are quite large, are dominated by one or two stocks, and these shares may not be attractive from the perspective of stability, quality and price.

For these reasons, investors should consider moving away from the benchmark—and allocating a small part of their portfolios to carefully chosen international stocks that can fill the gaps in the Australian index.

Next step: Manage macro risks